Millennials, migration and the ageing boom are shaping a major shift in Australia's housing preferences. Find out how this may affect your rent roll business.

As the year winds down, economists, forecasters and demographers are delivering their final takes on 2025 and predicting what’s likely ahead.

One of the most looked-to voices in this space, Bernard Salt, recently released his latest report on demographic trends, painting a detailed picture of how Australians will live, work and age over the next decade.

These shifts will impact (and are already impacting) the property market. Here are some insights for the rental property industry to take note of from Bernard’s presentation, which we were lucky to have access to.

Millennials are exiting apartment living

The millennial generation, which once embraced compact city apartments and share houses, is entering a new life stage.

As more of them hit their late 30s and early 40s, they're opting for space, stability and lifestyle. Bernard Salt refers to this transition as the move from “apartmentia” to “forever homes”.

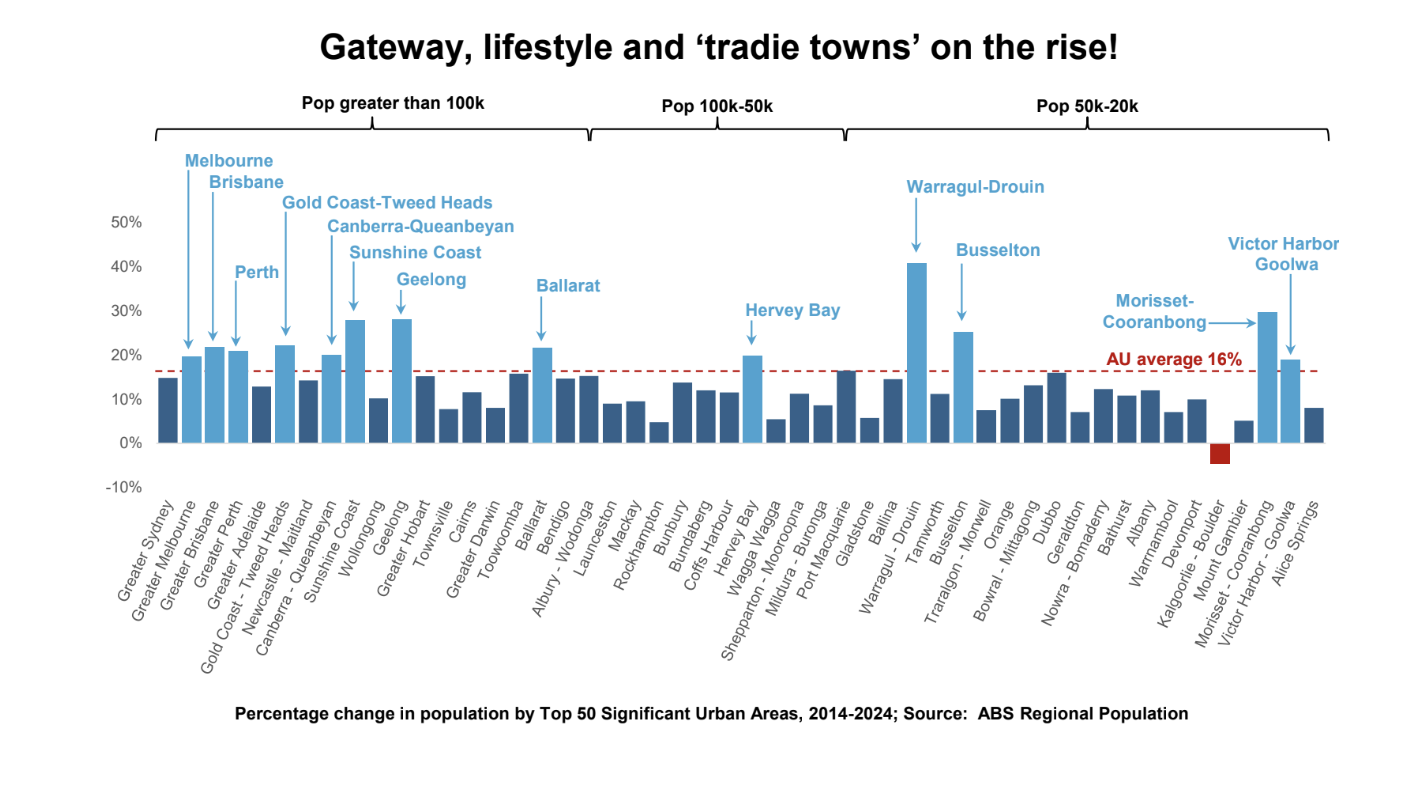

This is already visible in the data. Population growth between 2025 and 2035 is projected to be strongest in those within the classic homebuying years of 30 to 49. The winners from this will be lifestyle suburbs and regional towns within commuting distance of capital cities. Victoria’s Geelong is one of the places seeing some of the fastest growth in the country as part of this.

For property investors, the implications are clear: demand amongst millennials is shifting from dense inner-city rentals to spacious homes in lifestyle regions.

For rent roll owners, expanding to new areas is an option, in order to capture the millennial migration. Otherwise, it’s all about ensuring smaller apartments appeal to Gen Z.

Work from home is now a permanent fixture

The hybrid work revolution triggered by the pandemic was not a passing trend, even though some employers are pushing harder for a ‘back to the office’ approach. According to Salt’s analysis, about 15% of the Australian workforce is expected to work from home on an ongoing basis by 2026. Meanwhile, other research shows 47% of Australians work from home, at least some of the time.

This has had a flow-on effect on the types of homes people want. Floor plans have evolved to include home offices and spare bedrooms which can double as ‘Zoom rooms’. Meanwhile, gyms, battery storage, home veggie patches and EV chargers are more in demand.

Work, life and leisure now happen under one roof. For renters, this means more interest in houses with room to breathe rather than proximity to the CBD.

For rent roll businesses, this changes the game. Properties which once appealed only to families may now attract remote workers, pushing demand up in outer-metro and regional rental markets. Meanwhile, any property with a home office set up has instant renter appeal.

The ‘rent for life’ mindset is softening

While long-term renting remains a reality for many Australians, there’s a noticeable tilt toward ownership among older millennials and younger Gen Xers. Homeownership is still seen as a rite of passage, even if it's delayed by a decade compared to previous generations.

At the same time, the diversity of Australia’s renting population is increasing. With immigration levels back on the rise and Australia’s migrant mix evolving (there are more arrivals from India, the Philippines and Nepal, and fewer from China) rental property expectations and needs are changing. New arrivals often rent first, but as they settle, they look for more family-focused and long-term options.

This opens opportunities for investors to build portfolios which reflect the needs of a broader cross-section of the community. This includes multi-generational housing, suburban family homes and properties in culturally diverse neighbourhoods.

The ageing freight train is on its way

There’s no denying the fact Australia is heading into a significant demographic shift. By 2032, the 85+ age group will grow by over 60,000 people per year, putting enormous pressure on the aged care services and housing options designed to support ageing in place.

In the private rental market, senior Baby Boomers could increase demand for single-level homes, accessible home features and quiet, community-focused locations. Older investors may also start to offload properties to fund retirement or aged care, potentially releasing more properties onto the market and giving investors expanded opportunities to buy.

From a rent roll perspective, this is worth keeping in mind. How could accommodating and supporting seniors bring potential for your business, and what will you do if older investors begin to liquidise their properties?

Looking ahead

A recent report from Cotality suggested housing prices in capital cities could increase by 10% in 2026, so in the short term rent roll owners can expect healthy activity in the new year as investors enter and aim to take advantage of continuously positive conditions.

Meanwhile, Australia’s housing market is being pulled in new directions by the way we live, work and age. Being aware of trends is helpful in order to anticipate and prepare for changes in market demand.

From a rent roll perspective, the opportunities always lie in the places where people are motivated to live and the types of homes they want to live in. Shape your rent roll around both and you’ll be on track to expand in 2026 and beyond.

FAQ’s

-

Start by mapping where millennial demand is heading in your part of the world, including lifestyle suburbs, growth corridors and commutable regional centres. If you’re open to expansion, consider partnering with local agencies in those hotspots or acquiring management rights in emerging areas. If you’re staying metro-focused, position smaller apartments to suit Gen Z by highlighting convenience, affordability and shared-living-friendly features (like flexible spaces, strong internet, and walkable amenities).

-

Renters are increasingly prioritising space and function over a CBD postcode. Homes with an extra bedroom, study nook or adaptable living area are more appealing because they support hybrid routines. Practical upgrades also lift demand: reliable NBN access, good natural light, acoustic separation between rooms, EV charging and outdoor space all add value. Even modest properties can compete well if they clearly offer a comfortable set-up for working and living under one roof.

-

Expect growth in demand for single-level homes, low-maintenance living and accessible features such as step-free entries, wider doorways and safer bathrooms. Location will matter too, as quieter neighbourhoods near health services, shops and public transport will be attractive. For investors and rent roll operators, this trend creates two opportunities at once: improving or acquiring senior-suitable stock, and staying alert to increased listings as older owners sell to fund retirement or care needs.